how to claim utah solar tax credit

Install Your Solar Panel System The first. To receive the Utah Solar Tax Credit you must contact.

Renewable Energy Systems Tax Credit Office Of Energy Development

Determine if youre eligible 2.

. This incentive reimburses 25 of your system cost up to 1600. IRS Form 5695 is specifically for documenting your tax savings for the solar tax credit. The credit is for 25 of your total system cost up to a.

Most CPAs will be versed in this credit and can help you. In this section we will highlight 5 different steps that you need to take in order to receive the residential solar tax credit in Utah. To claim the credit you must file IRS Form 5695 as part of your tax return.

Net Metering Net metering. The process to claim the Utah renewable energy tax credit is actually relatively simple. Incidentally the form also allows you to write off wind energy and geothermal energy.

Utah homeowners have access to the Utah Renewable Energy Systems Tax Credit which is the state solar tax credit. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply. There are three main steps youll need to take in order to benefit from the ITC.

You claim the federal solar tax credit on your annual federal tax return through the Internal Revenue Service IRS. State All of Utah can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment AND installation costs for an unlimited amount. Following your solar power installation you can only claim the solar tax credit once.

For example if your solar PV system installed in 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as. In Utah you can claim up to 1600 in tax credits for switching to solar energy. So the big question is how much can you save with the.

How to apply for the solar tax credit. Attach TC-40A to your Utah return. You can claim the state credit for more than one system as long as each one is installed on a residential unit that you own or use.

It involves filling out and submitting the states TC-40 form with your state tax returns. How to Apply For the Federal Solar Tax Credit After seeking professional tax advice and ensuring you are eligible for the credit you must complete and attach IRS Form 5695 to your federal tax. Your system must serve your home or business to be able to claim the IRS Solar Tax Credit.

What are the steps for claiming solar tax credit in 2022. Renewable energy systems tax credit If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your.

15 Things You Should Know About Utah Solar Incentives

Revision Energy S Guide To The Federal Solar Tax Credit

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Federal Solar Tax Credits Incentives

Everything You Need To Know About The Solar Tax Credit

Itc 2022 How Does Federal Solar Tax Credit Work Marca

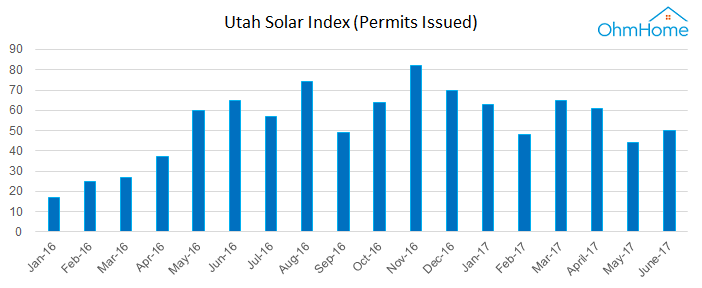

Cost Of Solar Panels In Utah Best Solar Companies Cost And Installation Ohmhome

Federal Solar Tax Credit Guide Atlantic Key Energy

Federal Solar Tax Credit For Homeowners 2022 Guide

How To Claim The Solar Panel Tax Credit Itc

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse Solar Llc

Massachusetts Solar Incentives Tax Credits Guide 2022

Utah Solar Incentives Tax Credits Rebates Guide 2022 House Method

Understanding The Utah Solar Tax Credit Ion Solar

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto